The current investment environment is riddled with uncertainty. The average market strategist is predicting a recession, though the timing, severity and length are guesswork at this stage. This is the type of environment in which quality companies not only survive but can also strengthen their businesses for the long-term.

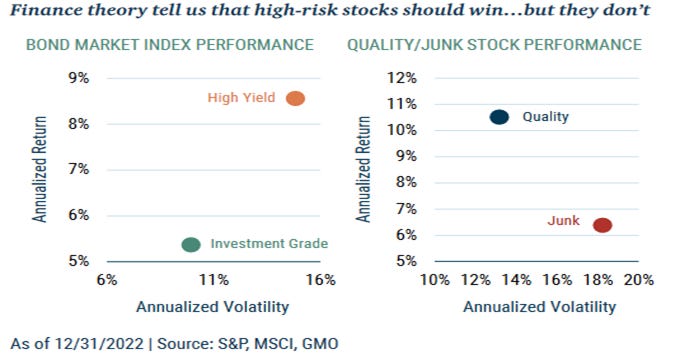

A study by GMO found that quality as a factor defies a general axiom of investments. Seeking higher returns generally demands taking on more risk. Over the last decade, however, quality stocks have outperformed lower-quality stocks by a wide margin despite being less risky (as defined by volatility).

Quality businesses are less cyclical. A soft or even hard landing will lead to inevitable earnings downgrades for all businesses, but in the past, downgrades for quality have been less severe.

Quality companies are also less exposed to the interest rate cycle. Their valuations may ebb and flow with the rise and fall of the determined cost of capital, but the cash flows generated by these businesses will remain. Cash generative businesses can sustain operations and expansion initiatives through self-funding. Their higher returns on capital also permit them to invest through the cycle despite the higher cost of capital.

Lower quality companies usually rely on external financing to fund their operations. If that source dries up, so does their ability to generate cash. Similarly, debt loaded businesses with a short maturity profile will be hindered by higher finance costs. Projects may also have to be cancelled as the expected IRRs are now insufficient to cover the projected costs.

Since the market should be able to adequately price for a quality company’s better fundamentals, how then, does quality still outperform? Studies suggest that analysts and investors frequently underestimate the future earnings of high-quality firms compared to low-quality firms. Said differently, investors like to bet on something that is exciting with a huge potential payoff (e.g., “COVID Winners”) while neglecting the clear but boring characteristics of quality stocks.

Another factor has to do with relative performance. Quality as a factor generally underperforms in bull markets. Markets have been in bull territory for ~72% of the time throughout history, so logically, if a manager wants to outperform, quality won’t allow them to stand out. The flipside to this argument is that quality more than claws back the performance differential in bear markets. Remember the Law of Losses: a percentage loss hurts your portfolio more than an equal percentage gain helps it. That's because a percentage loss can only be erased by a larger percentage gain, regardless of whether the loss or gain occurs first.

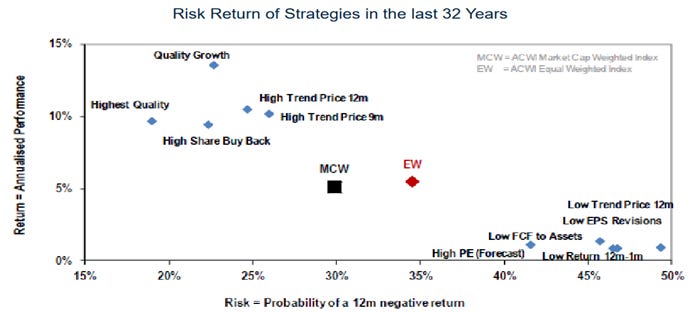

The data provided by GMO is supported by a more granular study done by Bank of America Global Research (shown above). Here quality is split into different sub-categories, but the base conclusion is still that high quality businesses provide compelling risk/reward.

My Personal Case for Quality

All studies of past returns, as we know, may not be representative of the future. The world can change in meaningful ways. For me, however, investing in quality businesses suits my personality and lets me sleep at night. There are two main aspects about quality investing that make it particularly attractive to me.

1) Consistent Compounding

An important metric for quality investors is return on invested capital. By definition, a company is creating economic value if it is generating returns on its capital in excess of the cost to fund it. Companies are just like people. If someone borrows money that costs 15% and invests it at a return of 10%, they become poorer.

“Whilst fund managers await the kiss that will turn their corporate frogs (low quality businesses) into princesses, they steadily erode value (given ROCE is less that WACC).” – Terry Smith

Businesses with high ROICs ensure that intrinsic value is consistently increasing, as long as they are reinvesting a portion of their earnings at those same attractive rates. Conversely, economic theory suggests high returns incite competition, so at some point economic value creation will begin to decline.

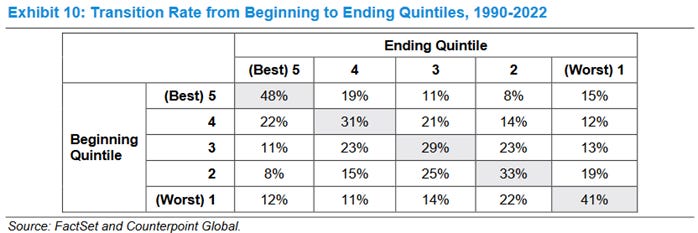

Research by Counterpoint Global found that due to economic moats, companies with high returns on capital tend to hold on to their advantages, while bad businesses generally stay bad.

“These results naturally prompt the question of the rate of transition from one ROIC quintile to another over time. Exhibit 10 shows those results for 3-year periods from 1990 to 2022. The most common outcome for a company within a starting quintile is to end up in the same quintile.”

2) Turnover minimization.

Holding quality stocks helps to minimize transaction costs and other psychological failings. I prefer to own several businesses and hold them for as long as possible, rather than consistently looking for turnaround/cheap situations and recycling new ideas regularly.

“Many investors like to take profits after a share has risen in value, in the hope or expectation that the share price will decline and they will be able to buy them back at a lower price. This practice is known as market timing and can be hugely costly. To be successful it requires two correct decisions: the first, to sell at the right time, the second, to buy back at the right time. Get either wrong and the loss will be permanent. Trading too actively increases the risk of such an outcome. It is one of the reasons many professionally managed funds fail to perform as well as they should.” – Terry Smith

Low turnover does not mean I am inactive. Choosing to stick with companies over the long term requires consistent monitoring of the portfolio for degradation in fundamentals or loss of competitive advantages. It requires courage to change one’s mind and to sell, even at a loss, if circumstances have changed and an investment has lost the potential of a serious return. For more information on selling, read my post on the topic.

Conclusion

Through all investment landscapes, the enduring appeal of quality is evident to me. Investing in these businesses helps me to mitigate my biases, narrow my focus, and solidify my process.